YOU Can Own a Home!

At the Housing Development Alliance (HDA), we believe that a good, quality, affordable home should be available to every person and family in Eastern Kentucky. It’s where you’ll grow. It’s where you’ll raise a family. It’s where you’ll spend most of your life.

We’ve helped 365 families realize their dreams of owning a new home in the counties we serve: Breathitt, Knott, Leslie, and Perry. And we can help you, too! Transform your life and your family’s future in your own forever home.

When a family comes to us for help getting a new home, we work with them from start to finish. From the moment a family qualifies and papers are signed to the moment we close on the home and the family receives the keys, we’re there with them every step of the way.

This close relationship allows us to prepare each family for homeownership through Housing Counseling, where our NCHEC (NeighborWorks Center for Homeownership Education & Counseling) Certified counselor coaches families on managing finances, budgeting, home maintenance, and more so that they have a much better chance at long-term success. The path to homeownership is not a short and simple one – families are not simply given homes; it’s a process that requires commitment, time, and dedication.

If you’re ready to be a homeowner, we can’t wait to meet you! You’ve arrived at exactly the place you need to be, and we look forward to working with you on making your dreams come true.

You pick your floor plan, and we do the work! Our expert builders will construct the home of your dreams, using your choices in design, flooring, paint colors, light fixtures, and more. Let’s build your dream home!

We’ll get you where you want to be! If you don’t already have a piece of land to build on, our Land Agent works with you to find the ideal spot for your new home in Breathitt, Knott, Leslie, or Perry County.

Our goal is to build you a forever home. That means it should be a house you can afford. All HDA homes are energy efficient (Energy Star Certified) and will save you hundreds of dollars on utility costs each year!

The HDA Homeownership Program is income-based, which means that we help low-income individuals and families achieve their dreams of homeownership. That means that the first thing we consider is the level of need and that the prospective homeowner has a demonstrated need for affordable housing. Then, we must determine if the prospective homeowner is able and willing to pay an affordable mortgage.

Prospective homeowners apply for homes through HDA because they are in need of better housing or want to own a home they can afford. Often, they are looking to leave a current housing situation, which can be anything from not being able to afford rent or a current monthly house payment, having a home that has fallen into disrepair, the desire to have a stick-built house instead of a mobile home, or the need for a home that allows for aging in place or for more safety due to a disability. Of course, the reasons for needing an affordable home are not limited to these examples, and in some instances, none of these things apply. Sometimes, a new, affordable home is simply the dream.

Unfortunately, not every low-income person or family who reaches out to us will qualify for our program. That’s because our program is funded by state and federal programs that each have their own guidelines for qualifying that must be met. We try, in every way possible, to work with each individual or family to help them qualify and meet the requirements.

HDA serves only the counties of Breathitt, Knott, Leslie, and Perry in southeastern Kentucky. Occasionally, we have funding available to offer programs and services in Floyd County. The families we serve must either already live in one of these counties or agree to live in a county we serve.

If you need housing help but live outside our service area, click here for info on our sister organizations throughout East Kentucky and nearby states.

Like most housing assistance programs, eligibility for our Homeownership Program is based on the area median income, or AMI. The AMI is the household income for the median, or the middle, household in a region. Each year, HUD (the Department of Housing & Urban Development) calculates the AMIs for every region of the country, and we base our eligibility requirements on their estimates.

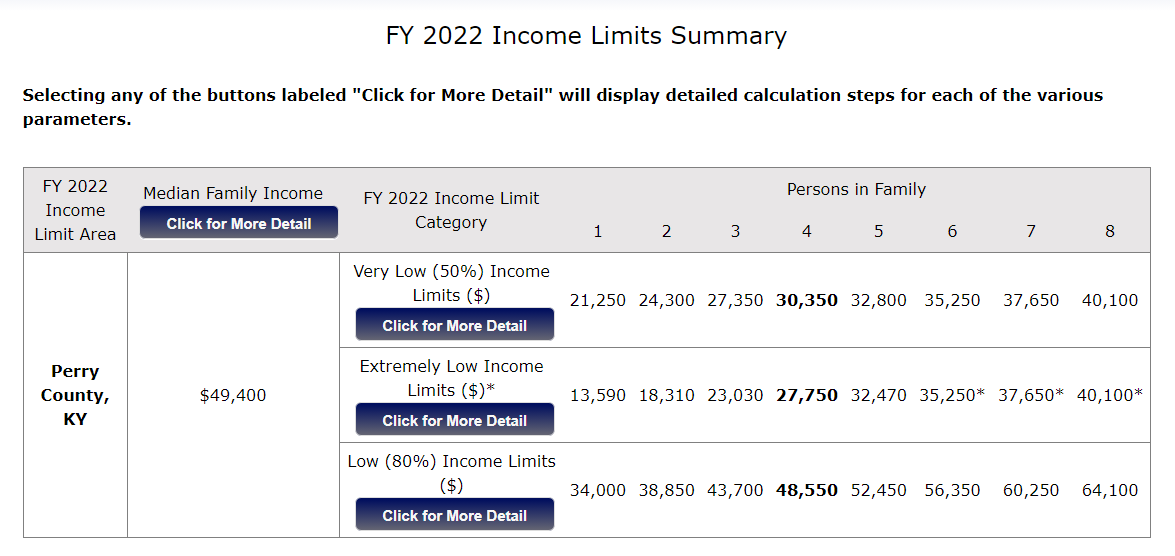

They begin with the median income for a family of four. In our region, the AMI for a family of four is currently $49,400. Since our service area includes some of the poorest counties in the country, this AMI is one of the lowest in the nation.

The table below, provided by HUD, shows the median incomes for various household sizes in Perry County, KY. (The example given for Perry County is the same or similar for all of the counties we serve.) We determine whether a family is eligible for our Homeownership Program based on a comparison of their income to a percentage of the AMI. As you can see, families often fall into one of three categories: 1) Extremely-Low Income (earning less than 30% of AMI); 2) Very-Low Income (earning less than 50% of AMI); and 3) Low-Income (earning less than 80% of AMI). These calculations help us determine what is affordable for a family.

We help families of all sizes. Single folks can apply, too! We also support Equal Housing Opportunity.

There are different income requirements for families based on size simply because family incomes differ by the number of people in a household. Again, we use HUD income requirements based on household size to determine eligibility. These requirements are used by every affordable housing program in the region. HDA has helped families of all sizes and backgrounds. If you have questions, please contact us!

Don’t let this requirement hold you back! This topic alone creates a lot of fear – and in some cases, hesitancy and embarrassment. We want you to know, though, that there is no need to feel this way! Your information is kept confidential, and more than anything, we are here to help.

It’s important to note that your credit rating is important, but it’s not a make or break requirement. We’ve helped lots of individuals and families achieve homeownership through credit counseling and debt management. This is made available to you through Housing Counseling, which is a free service offered to you through our program. In fact, every family receives some form of Housing Counseling to get them ready for homeownership. We just tailor it to the needs of each family.

Determining your debt load and credit history helps us determine the kind of home loan package we can negotiate for you and whether or not you are able to pay an affordable mortgage. If you qualify for our program but your credit/debt needs attention, we’ll get you where you need to be so that your financial situation does not prevent you from owning a home.

In addition to Housing Counseling, HDA homeowners contribute up to 150 hours of “sweat equity” in which they help to build their own home. These work hours offset some of the construction costs of their home. Every family is required to contribute sweat equity and participates in whatever ways they are physically able – from landscaping and painting to flooring and roofing … and in many cases, all of these! Prior experience in construction work is not required as our on-staff carpenters are always present to guide the way.

Qualification guidelines can change quite often, and when considering household size, income level, and other unique situations, we prefer talking with families directly. If you're interested in HDA's Homeownership Program and have questions about qualifying, please contact our office by calling 606-436-0497.

Read the FAQsWe believe the simple fact of owning your own home has the power to change the future. While we can’t promise that owning your own home will open every door and solve all of life’s problems, we do believe that making a better life for yourself is easier if you have the strong foundation and financial stability an affordable home provides.

Our staff will collect information from you to determine if you qualify for our Homeownership Program. If you are eligible for our program, our staff member will let you know what documents you will need.

Michael Cassell, Intake Specialist

Office: 606-436-0497

Every East Kentucky family deserves a home they can afford. Help us transform lives through affordable housing!

Want to be a part of HDA? Sign up for our Email List to get news and exclusive updates, info on local and regional volunteer opportunities, timely reminders about events and fundraising activities, details on how to donate, how to receive our newsletter, and more!

© 2021 – Housing Development Alliance | Designed by The Holler

If you would like to take part in HDA’s traditional Volunteer Program, our Ultimate House Raising Challenge, or in providing Flood Disaster Recovery, please fill in your details below.

Shortly after the form is received, our Volunteer Coordinator will reach out to you. If, for some reason, you haven’t heard from us within a week of submitting the form, please call us at 606-436-0497.

Please Note: This is just an inquiry form. There are more forms you must fill out, sign, and send to us before the process is completed. So, let’s get started!

"*" indicates required fields

Sign up now to participate in one or both of our special Days of Service in remembrance of last year's devastating flood.

"*" indicates required fields

Please fill out this contact form and let us know what kind of help you need. A member of our staff will contact you ASAP.

"*" indicates required fields